Creating a winning SaaS pitch deck is no small feat. With investors reviewing countless proposals, yours must clearly demonstrate your business’s potential to stand out. Supported by the right metrics, a data-driven approach will make all the difference in convincing investors to back your vision. In this post, I’ll break down the essential elements of a successful SaaS pitch deck to help you secure funding and drive growth.

Why Metrics Are the Backbone of Your SaaS Pitch Deck

Prospective investors will spend an average of just 3 minutes and 44 seconds reviewing your pitch deck. You’ve got to make your case well and do it quickly.

Metrics are the foundation of a great SaaS pitch deck. They validate your claims, showcase your growth, and provide a clear picture of your scalability. Once you know how little time you’ve got, it’s clear that there is no room for ambiguity—your data must be impactful and easy to understand.

When investors see well-presented, relevant data, they’re more likely to trust in your leadership and vision. Presenting the right metrics allows you to build a narrative of credibility and confidence, but which ones should you focus on?

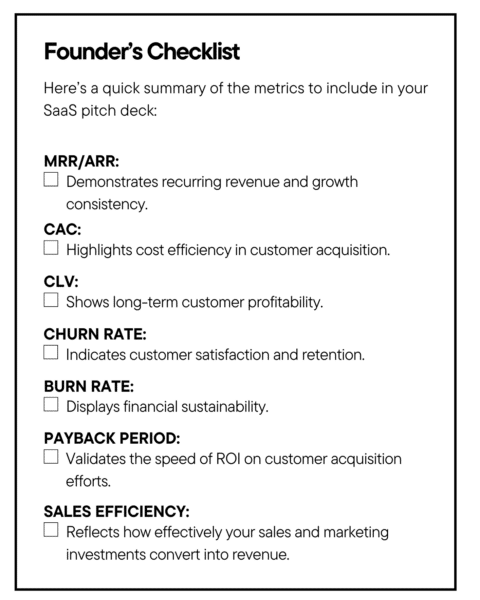

Let’s take a look at the metrics you should prioritize to make your SaaS pitch deck a standout.

Key Metrics Every SaaS Pitch Deck Must Highlight

Including the right metrics ensures that your pitch deck tells a compelling story. Here are the most important categories to focus on:

1. Revenue Metrics: The Pulse of Your Business

Revenue metrics demonstrate your financial health and growth potential. Prioritize the following:

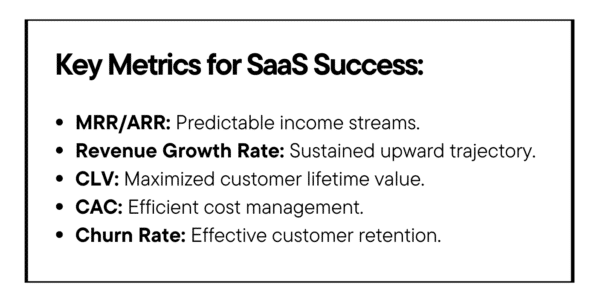

- Monthly Recurring Revenue (MRR) and Annual Recurring Revenue (ARR): These metrics highlight your predictable income streams and growth trajectory. For example, SaaS companies with ARR growth above 40% are six times more likely to become market leaders, according to McKinsey.

- Revenue Growth Rate: Showcase your month-over-month or year-over-year growth to illustrate scalability. Highlighting consistent growth in these areas reassures investors of your upward trajectory.

- Customer Lifetime Value (CLV): Make sure you know how to calculate LTV and share that information in your pitch deck. A high CLV indicates strong customer retention and upselling opportunities, key drivers of long-term profitability. Investors look for a CLV-to-CAC (Customer Acquisition Cost) ratio of at least 3:1 as a benchmark for efficiency.

2. Customer Metrics: Gauging Engagement and Satisfaction

Your customer metrics reveal how well your product resonates with your target audience. Include these to improve your SaaS pitch deck:

- Customer Acquisition Cost (CAC): Investors want to see efficient marketing and sales processes. A lower CAC relative to CLV signals that your efforts to acquire customers are cost-effective and sustainable.

- Churn Rate: A low SaaS churn rate signals high customer satisfaction and retention. Compare your churn rate to the SaaS industry average of 5% to provide context. For instance, a churn rate of 3% demonstrates your ability to retain customers effectively.

- Net Promoter Score (NPS): A high NPS indicates strong customer loyalty and advocacy, both essential for long-term growth. Use customer testimonials or case studies to further emphasize satisfaction levels.

3. Operational Metrics: Insights into Execution

Operational efficiency is crucial for demonstrating your team’s ability to scale sustainably. Focus on these in your SaaS pitch deck:

- Burn Rate: Detail your monthly cash outflow and runway to show financial sustainability. Investors want to know how long you can sustain operations with your current funding.

- Payback Period: Highlight how quickly you recover your CAC. Shorter payback periods demonstrate faster returns on investment and a more sustainable business model.

- Sales Efficiency: Revenue generated per dollar spent on sales and marketing efforts reflects how well your team leverages resources.

How to Present Metrics Effectively

Investors appreciate data that is clear and visually engaging. Use the following techniques:

Charts: Display MRR/ARR growth trends with line or bar charts to make patterns more accessible.

Tables: Break down CAC versus CLV for easy comparison and quick reference.

Infographics: Summarize churn rate and NPS in visually appealing formats that draw attention without overwhelming.

The Power of Benchmarks

Always provide context for your metrics by comparing them to industry standards. For example, if your churn rate is 3%, highlight that it outperforms the industry SaaS churn rate benchmark of 3.5% to 5.7%. While it’s still too soon to validate, Gartner projected that the global SaaS market would grow to $232 billion by the end of last year. Relating your metrics to this growth potential positions your business as a strong contender in a thriving market.

Common Pitfalls to Avoid

While metrics are critical, missteps can detract from your SaaS pitch deck. Watch out for:

- Overloading Slides: Too much data can overwhelm investors. Focus on the most impactful metrics that tell a cohesive story.

- Unverified Data: Always use credible sources to back your claims. Citing a well-known and well-respected organization like McKinsey or Gartner enhances your pitch’s credibility.

- Ignoring Benchmarks: Providing context for your data helps investors understand its significance.

A Real-Life Example

Consider a SaaS startup that achieved a CAC of $120 and a CLV of $450. By presenting these figures alongside industry benchmarks, the company demonstrated a 3.75:1 CLV-to-CAC ratio, surpassing the ideal 3:1 standard. Coupled with a 40% ARR growth rate, this made a compelling case for investment.

The Importance of Context and Storytelling

Metrics alone won’t win over investors. Combine data with a compelling narrative that highlights your unique value proposition and growth strategy. SaaS expert Tomasz Tunguz notes, “The best SaaS businesses create a flywheel where satisfied customers lead to increased retention and upselling opportunities.” Use your metrics to demonstrate how your business achieves this dynamic.

Visual Variety: Using Lists and Examples

In addition to charts and tables, incorporate bullet points for clarity and engagement. For instance:

This structure keeps your pitch organized and reader-friendly, ensuring investors can quickly grasp your business’s value.

Tell Your SaaS Story Through Metrics

A well-crafted SaaS pitch deck is more than just a collection of numbers; it’s a story of potential and promise. By including essential metrics like MRR, CAC, and churn rate, and presenting them in a visually engaging way, you can build investor confidence and showcase your ability to scale sustainably.

Remember, your pitch deck is your gateway to SaaS finance. Use it to tell a data-driven story that highlights your strengths, sets you apart in a competitive market, and gets you the funding you need. With the right combination of metrics, visuals, and narrative, you’ll be well on your way to securing an investment to take your SaaS business to the next level.